Telesat: Zero news on Lightspeed

May 15, 2023

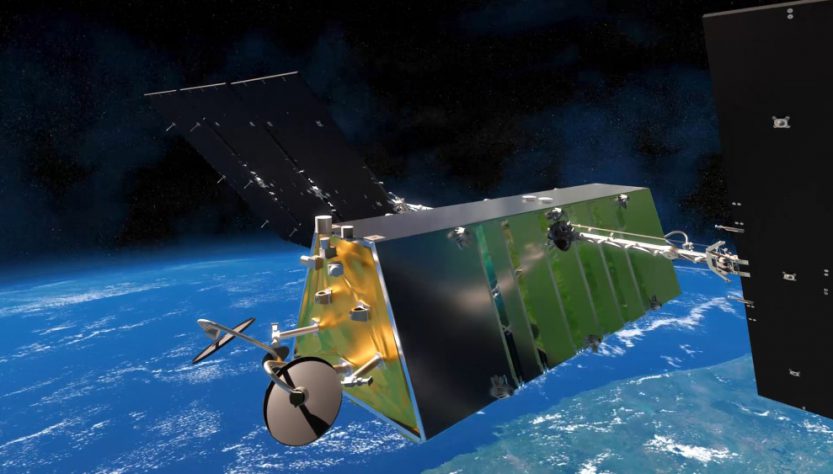

Canada-based satellite operator Telesat, which operates the Anik, Nimiq and Telstar satellites, failed to give investors or analysts any good news on its proposed $5 billion Lightspeed low Earth orbiting broadband fleet.

In fact, the news was depressing given the frequent past promises and assurances that all was well with the project. Telesat President/CEO Dan Goldberg attempted to give a positive spin saying that the company remained firmly optimistic, saying that “it’s not over until it’s over”.

Indeed, as if to hold out something of a lifeline for the project, Goldberg added that while Thales Alenia Space was the probable constellation builder, they and Telesat were not joined at the hip and suggesting that if another – less expensive satellite builder came along then they could be suppliers.

However, a non-French supplier could jeopardise the French export credit funding that came with a Thales Alenia contract.

Moreover, the Ka-band frequencies secured by Telesat for Lightspeed are now quite definitely under severe risk. Telesat should have complied with ITU regulations and notified the ITU’s Radio Regulations Board back in February of its satellite supplier, its rocket launch supplier and a timetable for events. That hasn’t happened.

The problem for Telesat is that – under current regulations – it should have launched 10 per cent of its 188 satellite fleet by this past February, and 50 per cent (another 99 satellites) by February 2026 (and 100 per cent by February 2028). It has obviously missed the first deadline and few can see it meeting the February 2026 deadline.

Goldberg addressed these concerns during Telesat’s results call with analysts, saying that if the long-awaited financing were to now be in place then Telesat could start launching in 2026 “around that time-frame”.

The consequences for Telesat (and Lightspeed) are extremely serious and these multiple missed deadlines will almost certainly mean that Telesat will lose its ‘priority’ rights to the frequencies secured for the Lightspeed project.

Telesat’s Q1 financials reported consolidated revenue of C$183 million, a decrease of 1 per cent (C$2 million) compared to the same period in 2022. When adjusted for changes in foreign exchange rates, revenue declined 5 per cent (C$9 million) compared to 2022. The decrease was mainly due to a reduction of revenue from one of Telesat’s North American DTH customers.

Telesat said it continues to expect its full year 2023 revenues (assuming a foreign exchange rate of US$1 = C$1.35) to be between $690 million and $710 million.

For 2023, Telesat continues to expect its cash flows used in investing activities to be in the range of $40 million to $70 million. Once Telesat has finalised arrangements around the construction and financing of its Telesat Lightspeed programme, it will provide a further update on the anticipated capital expenditures for the year.

Other posts by Chris Forrester:

- Project Kuiper seeks India licence

- FAA suspends SpaceX launches

- SpaceX vs AST SpaceMobile

- Eumetsat explains Ariane 6 cancellation

- AST SpaceMobile examines emergency call obligations

- AST SpaceMobile promises US commercial services

- Starlink “transformative” in shipping

- Rivada Networks funding explained

- EU satellites disrupted by Russia