Report: APAC markets to see SVoD revenue & subs growth

March 6, 2019

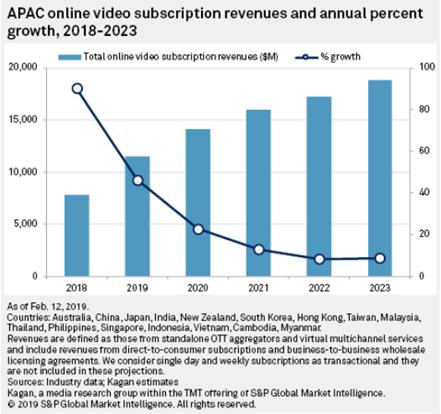

According to an analysis by S&P Global Market Intelligence, total Asia-Pacific subscription online video revenues and subscribers continue to grow, primarily reflecting the success of the Chinese market. However, the analysis anticipates growth in all Asia-Pacific countries covered as digital infrastructures improve, local services increase the value of content behind the paywall and international services increase localisation.

S&P Global has pegged 2023 as a possible time frame for when Disney+ revenues might be earned in larger, developed Asia-Pacific markets, but at this time S&P Global expects early revenues to be modest. In regard to Apple’s proposed subscription service, S&P Global views 2023 as a reasonable time frame for larger, developed markets to see modest revenues and subscribers.

The success of OTT services varies considerably across Southeast Asian markets given the significant differences in mobile and broadband penetration rates. Widespread digital piracy and the prevalence of ad-supported content pose as challenges for subscription video-on-demand growth.

However, the ad-based video-on-demand, or AVoD, model remains important to raise awareness and interest among viewers and encourages them to use legal video streaming services. Using a combination of AVoD, SVoD and transactional VoD, also helps make consumers more accustomed to paying for premium content. Content itself continues to be an integral part of establishing a presence in Southeast Asia. OTT players have realised the importance of providing differentiated content, with local and original production gaining prominence.