Report: Positive momentum in SEA premium VoD sector

May 7, 2024

The premium VoD landscape in Southeast Asia (SEA) is witnessing a robust resurgence, as revealed by the latest Q1 2024 analysis conducted by ampd, the digital measurement platform owned and operated by Media Partners Asia (MPA).

In Q1 2024, SEA’s premium VoD sector exhibited stability and growth, with a total viewership of 96.3 billion minutes, on par with the previous quarter. Notably, the region experienced a significant uptick in total paying subscriptions, reaching 48.5 million, representing net additions of 652,000 quarter-on-quarter and 1.6 million year-on-year. Such growth translated to a 9 per cent year-on-year and 5 per cent quarter-on-quarter increase in total subscription revenues to $381 million, marking a milestone as the highest quarterly revenue recorded in the region. Among the five markets analysed, Indonesia and the Philippines emerged as leaders in growth, with Thailand and Indonesia displaying strong market monetization scale, closely followed by the Philippines.

Vivek Couto, Managing Director of MPA, reflected on the Q1 2024 findings, commented: “Following a challenging period in 2023, the Southeast Asian premium VOD sector has demonstrated resilience and notable improvements since Q4 2023, a trend that has continued into Q1 2024. We’ve observed better monthly customer churn metrics, alongside a robust growth in subscribers and subscription revenues. Investment in local content and marketing has been strategic and for the most part, sustainable while leading platforms continue to invest in local entertainment and sports.”

Key trends include the enduring popularity of Korean and US content, serving as significant drivers of customer engagement across the region. Local content remains a cornerstone, particularly in Indonesia and Thailand, where successful platforms have adeptly tailored their offerings to resonate with local audiences.

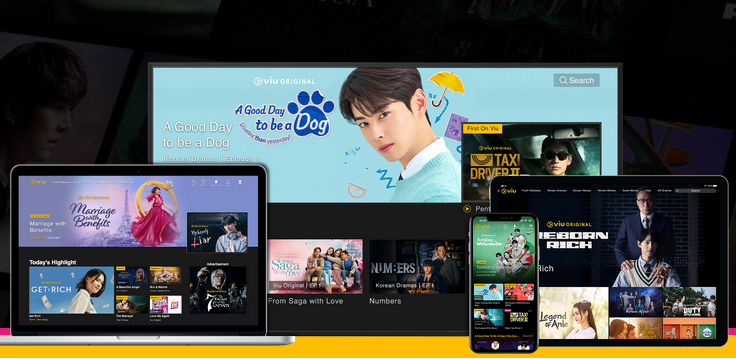

Netflix retained its position as the category’s top earner, commanding 49 per cent of Q1 SEA Premium VoD subscription revenue and 10 million subscribers in Q1 2024. Viu was in second place with 9.1 million paying customers and experienced double-digit subscription fee growth driven by market expansion and successful local hits. Disney grew revenues Y/Y despite churning customers arising from its strategy of raising pricing across direct and wholesale segments. Disney+ maintained its SEA Premium VoD subscription revenue share at 11 per cent.

In Indonesia, Vidio maintained its country leadership in terms of subscribers with 4.1 million customers fuelled, by premium sports content and local dramas. Meanwhile, TrueID in Thailand saw growth propelled by local originals, Premier League football and Japanese anime.

Korean dramas continued to reign supreme as the leading content category, capturing nearly 30 per cent of total premium VoD viewership in Q1 2024, closely followed by US content. Chinese content also made significant strides, particularly on freemium platforms across multiple markets including WeTV, Viu and iQIYI. The demand for local SEA content remains robust, particularly on freemium platforms, indicating a strong affinity among viewers. Impactful originals such as Indonesian dramas on Vidio and Thai content on Viu resonated strongly with audiences, underscoring the importance of local storytelling.